NEW New feature: Verify & block fake emails

We improve your ad performance by blocking click fraud and fake emails

Click fraud is costing advertisers billions in loses. Learn more here.

Click fraud is costing advertisers billions in loses. Learn more here.

Cyber fraud is the tax no e-commerce brand wants to pay. Yet it’s everywhere. For every $1 lost to fraud, merchants eat $3 in total costs once you factor in chargebacks, lost inventory, and wasted marketing spend.

But you don’t have to accept fraud as a cost of doing business. With the right fraud prevention strategy, you can block bad actors, protect your revenue, and give customers a seamless and secure checkout experience.

The value of global chargebacks is projected to cost $41.69 billion in 2028, according to a HubSpot report. That’s a 23% increase from 2025, which currently stands at around $33.79 billion.

But, the hidden costs hit even harder.

Every fraudulent transaction sets off a chain reaction:

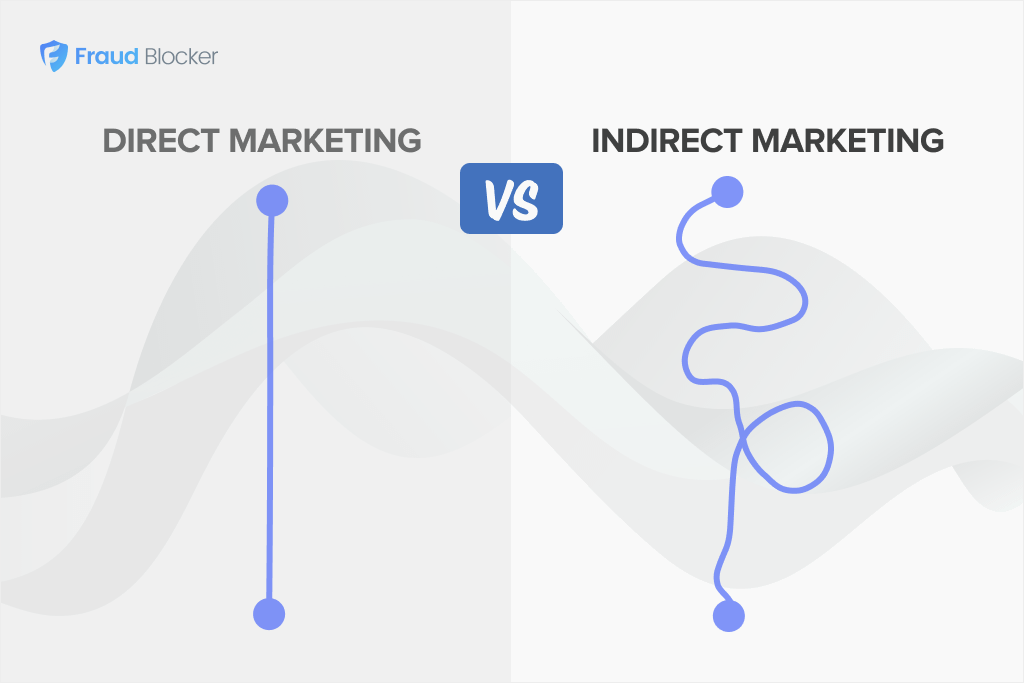

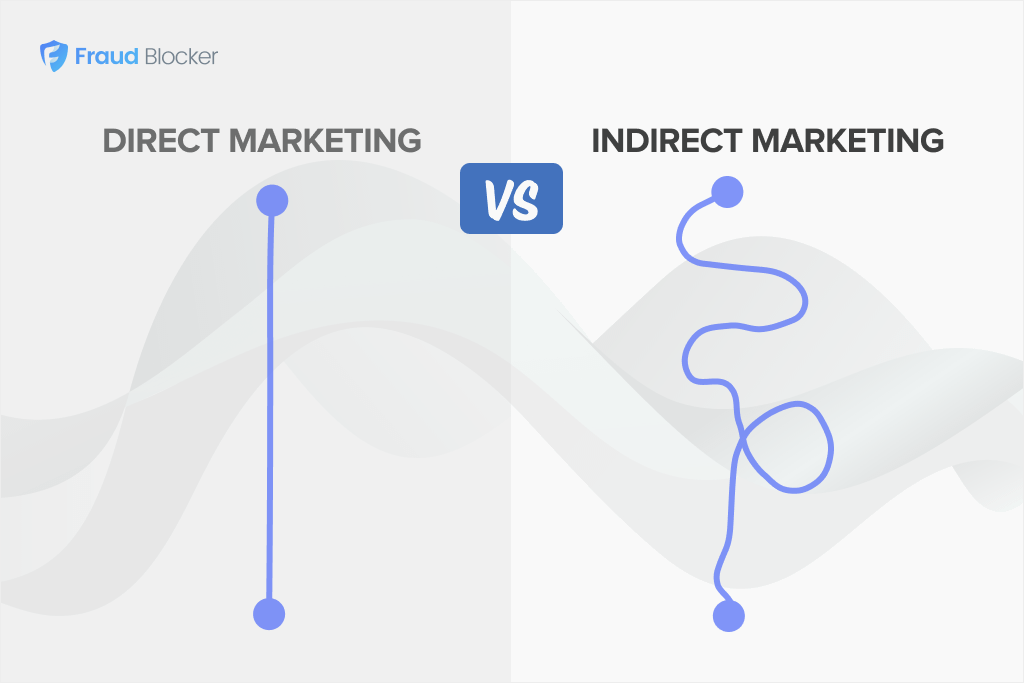

And fraud doesn’t stop at checkout. Many stores also lose money through click fraud, which involves fake traffic and bots that waste your marketing budget without generating real sales.

Each click on a paid ad that never converts represents wasted spend and distorted data, making it harder to optimize campaigns.

When you add it all up, you lose thousands of dollars. This often leads to your profit margins shrinking faster than you can grow them.

And it doesn’t stop at dollars. Fraud damages trust. Too many chargebacks, and your payment partners won’t want to work with you. Too many false declines (where you accidentally block a legitimate customer), and shoppers won’t return. Either way, your reputation takes the hit.

To build a comprehensive fraud prevention strategy for your e-commerce business, you need to think of it as a form of asset protection planning.

This means using a multi-layered approach to protect your revenue, inventory, and brand reputation from the constant threat of digital fraud. For example, by blocking fraudulent transactions and preventing account takeovers, you are not just stopping an immediate loss but also safeguarding your business’s long-term financial health and customer trust.

Risk checks are your first line of defense. They help you spot weaknesses before they turn into fraud losses.

Start mapping your customer journey, from account creation to checkout and returns. Ask: Where could someone slip through the cracks? Common red flags include multiple failed login attempts, mismatched shipping and billing addresses, or huge orders from new customers.

To make risk assessments more effective, focus on these key actions:

Manual review can only get you so far. Today’s fraudsters use tools, social engineering, data breaches, and automated scripts to scale their attacks. And they move fast. The only way to keep pace is with just as smart technology.

AI-powered fraud detection systems can flag suspicious behavior in real time, analyze transaction patterns across thousands of data points, and adapt as fraudsters devise new ways to exploit vulnerabilities.

Click fraud protection tools are equally critical to help prevent fraud. These systems will monitor your paid advertising traffic to identify and block bot clicks, competitors, and invalid traffic sources before they drain your marketing budget.

Advanced click fraud detection uses IP tracking, behavioral analysis, and machine learning to distinguish genuine customers from automated attacks, ensuring your ad spend reaches real potential buyers.

There are other digital tools, like device fingerprinting and velocity checks, image recognition, and intrusion detection systems. These add another layer by identifying abnormal activity, such as too many purchases in a short time frame or logins from unusual locations.

If you’re considering fraud detection technology, here are steps you can take:

Payment fraud doesn’t just result in lost revenue. It can also damage customer trust, tie up cash flow, and potentially increase chargeback fees.

While tools like fraud detection software and strong customer authentication are essential, the type of payment card you use on the business side can also make a difference.

One way to add an extra layer of protection is to use a secure business credit card that includes built-in fraud alerts, purchase protection, and zero-liability policies.

With these cards, any unauthorized charges are flagged quickly, giving you more time to respond and reducing the financial impact on your business. They can also simplify chargeback disputes, since many issuers provide dedicated merchant support and faster resolution processes.

Beyond cards, merchants should also consider adopting payment security protocols, such as 3D Secure 2.0, tokenization, and encryption. These measures make it significantly harder for fraudsters to exploit stolen credentials, ensuring your checkout process remains safe without driving away legitimate customers.

Here are some proven ways to strengthen payment security:

Policies might not sound exciting, but they’re one of the most effective fraud deterrents you can deploy.

Clear, well-enforced return and refund policies make it more difficult for scammers to exploit loopholes, such as “friendly fraud” or fake returns. For example, you can require proof of purchase, limit return windows, and charge restocking fees on certain products. All of these can help reduce fraudulent claims.

These policies also help when disputes do arise. They provide you with documented proof to present to payment processors or bank accounts during chargeback investigations.

The key is finding the balance: policies need to be protective enough to block abuse, but still flexible enough for a positive customer experience.

Other policy updates worth considering:

Even the best fraud tools can’t replace human judgment. Your frontline staff, whether in customer service, order fulfillment, or finance, should know how to quickly recognize suspicious activity and escalate issues.

Training sessions that cover red flags, phishing risks, and chargeback procedures pay off big in avoided financial losses.

On the customer side, education builds trust and reduces vulnerability. Reminders like encouraging shoppers to enable two-factor authentication, avoid reusing passwords, and check their statements regularly go a long way.

Fraud prevention is a partnership. When both your team and your customers know what to look for, fraudsters have a much harder time getting through.

Here’s how to make fraud awareness stick:

Fraudsters often seek vulnerabilities in cloud systems. There are “Cloud Security Posture Management” tools (CSPM tools for short), which allow you to automate security checks, reduce human error, and generally keep your e-commerce environment more resilient.

But cloud security is just one piece of the future-proofing puzzle. Fraud evolves fast. Synthetic identities, account takeovers, and “Buy-Now, Pay-Later” (BNPL) scams are becoming more common every year.

If your strategy stands still, you’ll always be playing catch up.

Here’s how you can stay a step ahead:

A comprehensive fraud prevention strategy strengthens customer trust, protects your revenue, and positions your small business for sustainable growth.

Each blocked chargeback, flagged account, and secured payment offers strong risk management while reinforcing your reputation as a reliable place to shop.

The stronger your cybersecurity defenses, the more confident your customers feel. And confidence is what keeps them coming back.

But protecting your store from fraud means looking beyond the checkout page. Every dollar you save from wasted ads is a dollar you can reinvest into campaigns that reach real customers.

If you’re ready to strengthen your defenses from checkout to campaign spend, start with Fraud Blocker and put wasted ad dollars back into driving growth. Begin your free trial today.

[This post was authored by Fraud Blocker’s editorial team.]